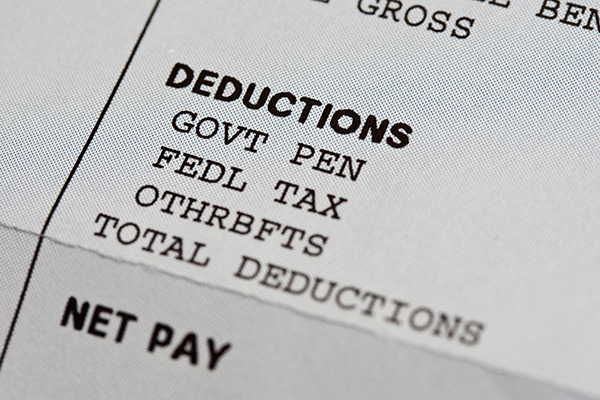

Payroll Tax Issues

Most tax problems are between you and the IRS. The IRS takes it seriously, but ultimately just wants to get its money out of you. If you’re having a payroll tax issue, though, the rules are completely different because you are now dealing with money that you withheld from your employees and you have a fiduciary responsibility to both them and the Government. This is known as the trust fund penalty issue. Failure to deposit payroll taxes on time, according to the IRS schedule will result in immediate penalties. Failure to pay the payroll taxes is a place you never want to visit. People you would never expect can be held responsible for repaying those taxes. the owner, that makes sense, the bookkeeper who prepared the payroll checks and returns, what!, any officer of a corporation, even if they had no knowledge the taxes were not paid. I could go on with this list but you get the idea. See more below.

Payroll tax penalties work differently from regular income tax penalties. The combination of failure to file, failure to pay and failure to deposit penalties can increase your tax bill by 33 percent, not including interest, if you’re just 16 days late paying after you file your 941 late. This is a drastic increase — much more than what it would cost to borrow the money to pay the taxes.

If you’re behind on your payroll taxes, though, penalties and interest are the least of your worries. The IRS has little tolerance for unpaid payroll taxes and will shut down your business to prevent you from continuing to leave your payroll taxes unpaid. It can padlock your doors, seize your assets and auction them off and tell your customers to send their invoice payments to them, instead of to you. the IRS collection office can do this quickly, too.

In addition to your business, the IRS can come after you personally.

Using the Trust Fund Recovery penalty the IRS can come after you personally even if your company is a corporation, the penalty is 100% of what your company owes. this 100% penalty can be assessed on more than one person. The IRS could also file federal criminal charges against you personally. The law is written to make it easy for them to prove that you didn’t intend to pay the taxes, too.

Payroll taxes are now all paid on line so there is no leeway when it comes to proving when the taxes were paid. They love cracking down on small businesses, because they know that there is frequently money there to collect.

If you have a payroll tax problem and are behind on payments, do not contact the IRS. If you say the wrong thing, you could be shut down. Instead, immediately hire a professional representative to talk with the IRS for you. His expertise in working with the IRS may be the only way you can keep your business, keep your personal assets and stay out of prison.

Contact us today.